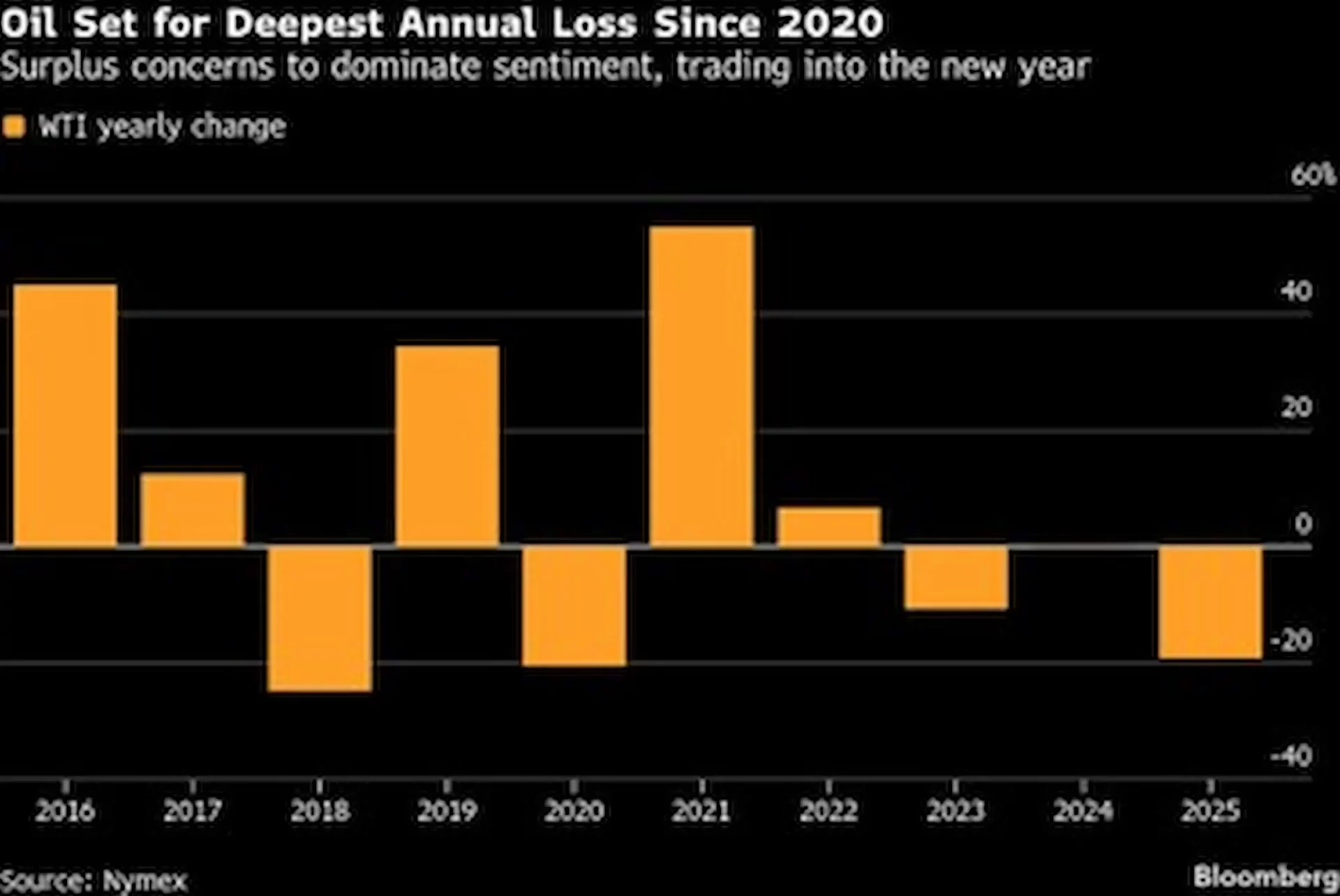

Oil Posts Deepest Annual Loss Since 2020 on Global Supply Glut Fears

By Naija Enquirer Staff

Global oil prices closed the year with their steepest annual loss since 2020, as mounting supply and persistent geopolitical uncertainties reinforced expectations of a prolonged surplus extending into 2026.

West Texas Intermediate (WTI) crude fell 0.9 percent to settle at $57.42 per barrel, completing a near 20 percent decline for the year. While short-term market attention remains fixed on an upcoming OPEC+ meeting and U.S. President Donald Trump’s policies toward Russia, Iran and Venezuela, the dominant long-term narrative has remained unchanged: the global oil market is oversupplied.

Both the International Energy Agency (IEA) and the U.S. government project that global oil production will exceed consumption by more than two million barrels per day in 2025, with the surplus expected to widen further in 2026.

Earlier this year, OPEC+ unsettled markets by increasing output, marking a sharp shift from its long-standing strategy of defending prices. The move appeared aimed at reclaiming market share as non-OPEC producers — notably Brazil, Guyana and the United States — continued to ramp up supply. U.S. crude production hit record highs, adding to downward pressure on prices.

Despite these developments, OPEC+ is widely expected to refrain from further output hikes at its talks this weekend, as producers weigh the risks of exacerbating the glut.

The slump in crude prices has helped ease global inflationary pressures, offering relief to central banks. In 2025, the U.S. Federal Reserve cut interest rates three times, and meeting minutes indicated that most policymakers viewed further reductions as appropriate. However, the sustained weakness in oil prices also threatens to strain the fiscal positions of major oil-producing countries and energy companies.

“The oil market is set to remain oversupplied into 2026, with strong non-OPEC production from the U.S., Brazil, Guyana and Argentina outpacing uneven global demand,” said Kaynat Chainwala, an analyst at Kotak Securities Ltd. She noted that prices are likely to remain range-bound between $50 and $70 per barrel, with geopolitical risks linked to Venezuela and Russia providing limited support.

In the United States, a weekly government report showed overall petroleum inventories climbed to their highest level since October, as builds in refined products outweighed draws in crude oil stocks.

China Storage and Market Buffers

Despite the sharp annual decline, several factors prevented prices from falling even further. For much of the summer, crude prices remained above $65 per barrel as surplus supply was absorbed into storage, particularly in China. This buildup occurred far from the pricing hubs that influence global benchmarks.

By contrast, storage facilities in Western markets remained relatively depleted. At Cushing, Oklahoma — the delivery point for WTI futures — inventories are on track for their lowest annual average level since 2008.

Additionally, soaring output of lighter, gas-rich hydrocarbons such as propane from U.S. shale fields has had a muted effect on crude pricing dynamics.

Geopolitical Risks Still in Play

Geopolitics continues to shape the market outlook. The United States is pushing diplomatic efforts to end the war in Ukraine, an outcome that could release Russian oil currently stored at sea. Meanwhile, Washington has intensified enforcement actions against Venezuelan oil exports, seizing tankers and contributing to recent production cuts in the South American nation.

President Trump also reiterated this week that the United States would strike Iran again if it rebuilds its nuclear programme. Brent crude briefly surged above $80 earlier this year following U.S. strikes on Iran, before retreating once it became clear the conflict was winding down.

As markets head into 2026, analysts agree that surplus supply — rather than geopolitical shocks — will remain the dominant force shaping oil prices.